Topics:

October 5, 2018

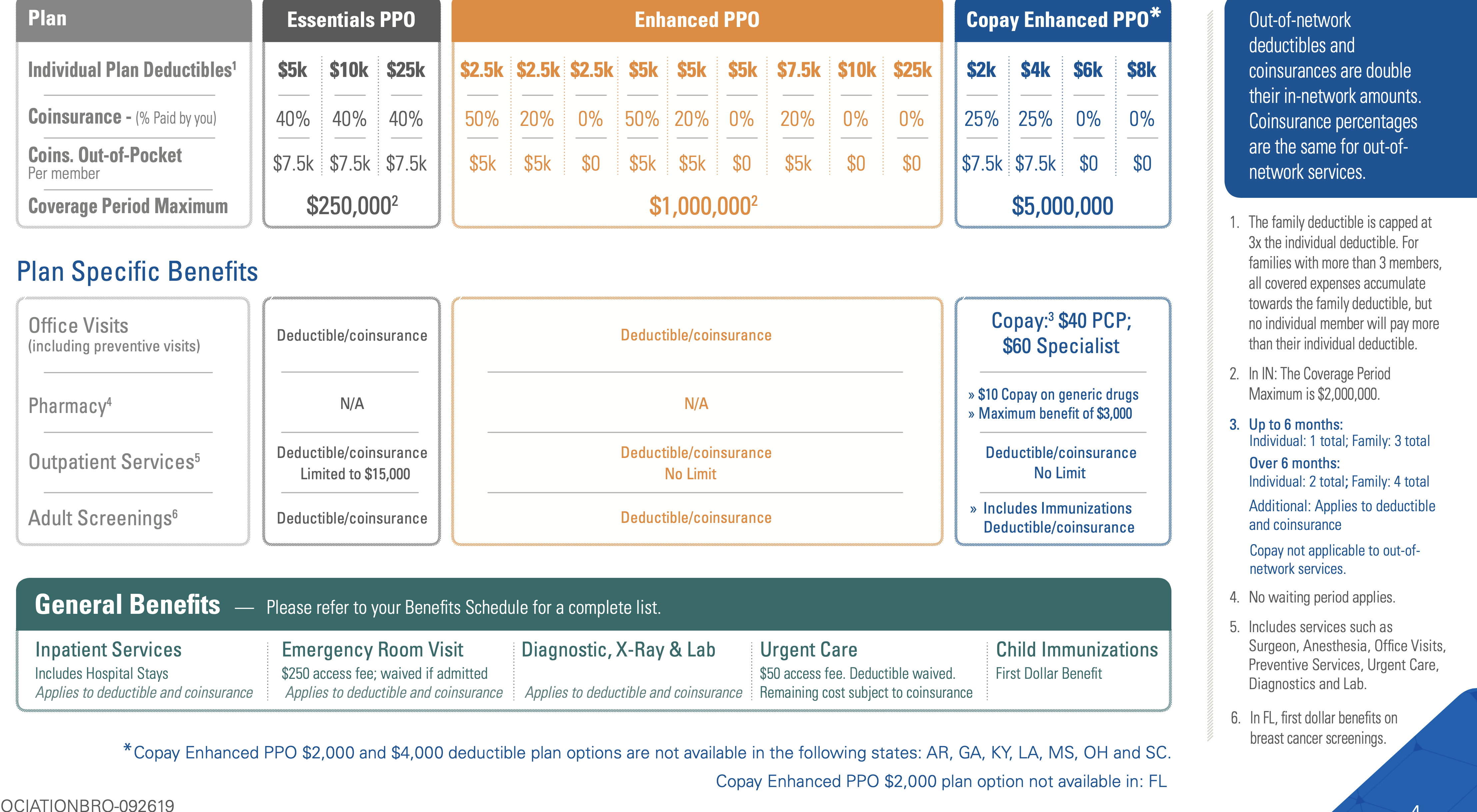

National General is an insurance company probably better known for their auto insurance. What most people don’t know is that they also offer some of the best “short term” or “catastrophic” health insurance on the market.

The bottom line: Because National General offers longer term options, a national network PPO, competitive lifetime limits, a $50 urgent care copay AND a guaranteed issue option (in most states), National General is a stand-out insurance provider in a crowded field of competitors. Few short term or catastrophic plans are able to offer these level of benefits at an affordable price.

Apply Now – National General PPO

The amount of time you can have a plan will vary by state, but in most cases you can get covered for up to a year.

Short Term Medical insurance, as its name implies, isn’t meant to be a long-term solution. While it covers some medical expenses, it doesn’t cover everything. Make sure you take a look at what you need your health insurance to do for you and compare it to the benefits provided through Short Term Medical.

| Covered | Not Covered |

|---|---|

| Doctor visits, urgent care, ambulance service and emergency room care | Outpatient prescription medications, eyeglass prescriptions and vision therapy |

| Diagnostic testing, mammograms, cancer testing, radiation therapy and Chemotherapy | Normal pregnancy, or diagnosis and treatment of infertility |

| Surgery, inpatient and outpatient hospital benefits, and hospital confinement benefits | Any medical expenses resulting from pre-existing conditions |

| Physical therapy, skilled nursing facility benefits and home health care | |

| Child immunizations, transplant benefits and more |

The examples provided are from larger lists of covered and non-covered services. For the complete listing of non-covered services, please refer to the Limitations and Exclusions pages in the attached brochure.

We’d be happy to have your join our team of independent agents.

JOIN NOW